Image

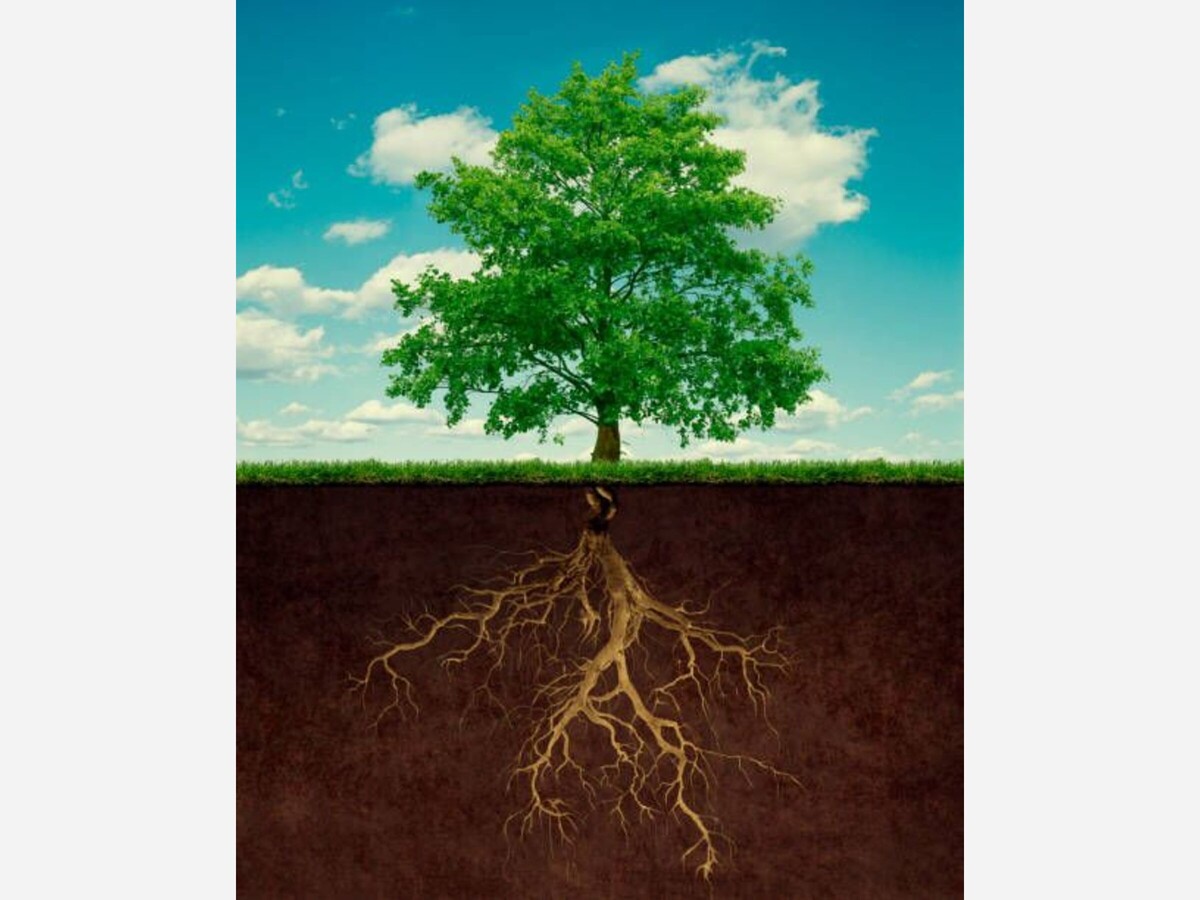

In segment one on the root cause of high costs, I discussed the high cost of living on LongIsland. State Senator Mario Mattera and I had discussed Governor Hochul’s proposal to override local zoning laws to encourage the creation of apartments and cottages in single family homes. The idea was to address the need for affordable housing on Long Island, given Long Island’s high home values, high property taxes, high rents and other punitive living expenses. Eventually the Governor dropped the idea, at least for now.

If indeed property taxes are a root cause for the shortage of affordable housing, and contribute to financial hardship for those homeowners or renters fortunate enough to even live on Long Island, then a strategy should be developed to lower property taxes which would likely make housing more affordable. Senator Mattera had suggested tapping into on-line gambling and lotto monies, which amounts to millions in revenue. This is something the State Legislature would have to consider.

Another prohibitive expense that we face, and it essentially effects all Americans, including Long Island residents, is the ever-escalating cost of college.

According to www.visualcapitalist.com, since 1980, college tuition and fees in the U.S. have increased by 1,200 percent. It was only because of a shift to online classes during the recent pandemic that we’ve seen a pause in the exorbitant increases, about 0.6 percent. Meanwhile, during the same period, the Consumer Price Index (CPI) for most items has risen by only 236 percent.

Back in 1980, it cost $1,856 to attend a degree-granting public school in the U.S. Since then, the figures have skyrocketed. As of January, of this year, the average cost of attendance for a student living on campus at a public 4-year in-state institution is $25,487 per year or $101,948 over 4 years. Private schools are much higher. This is according to https://educationdata.org.

With the outrageous rise in college tuition and fees has come the increased debt to finance it all. According to the US Department of Education, Student loan borrowers in the United States owe a collective $1.6 trillion in federal and private student loan debt as of March 31, 2021. This is spread out over approximately 43 million borrowers, which is one in 8 Americans (12.9%), according to May 2021 census data. Student loan debt has doubled since the 2008 recession. The average U.S. household owes $57,520, according to NerdWallet’s 2020 household debt study (www.nerdwallet.com)

One would think with the recent popularity of virtual learning, and a lessening demand for live classroom instruction, that the schools would cut their budgets and lower tuition costs. However there seems little evidence this is occurring, although some schools have opted to freeze tuition hikes in order to attract new students.

While it is difficult to comprehend the kind of increases in college costs that we’ve witnessed the past four decades, there are some possible explanations. These include:

Naturally, the schools will say that their costs, known as institutional expenditures, have also escalated over time. These include professor’s salaries, student services, administration, operating expenses, insurance and maintenance. However, many institutions and businesses deal with increasing costs and still don’t come close to eclipsing the CPI fourfold.

There is also the matter of endowments. An endowment is an aggregation of funds from donors who wish to support the mission of the college or university. Private donors believe their gifts provide financial stability to the institution. The purpose of these funds is pretty broad and can include student aid, faculty, academic programs, and research. College administrators say the endowments allow them to offer admission regardless of financial need and also provide financial aid to students who cannot afford full tuition, which as previously discussed has risen dramatically.

It still appears difficult to understand why the costs have escalated 1,200 percent over the past four decades. Although it seems the schools are eager to provide financial aid through state and federal programs, as well as endowments, we are still left with the 40 million borrowers to manage $1.6 trillion in debt. In other words, it’s not the school’s problem when their graduates are left to deal with this debt following graduation.

Getting back to endowments, according to the National Center for Education Statistics (NCES), https://usafacts.org/data, the median endowment at a private four-year colleges or university is roughly $37.1 million, while the median endowment at a public four-year institution is comparable at approximately $35.4 million. Again, the proponents will say that whatever its size, an endowment can provide critical support for their programs and finances. They further purport those endowments can only supplement, not replace, annual funding from tuition, grants, and for public institutions, state funding. It should be noted some schools have much smaller endowments or no endowment at all.

Meanwhile the average debt per student is roughly $36,520, according to https://usafacts.org. When including private loan debt, the average balance may be as high as $40,904. The average public university student borrows $30,030 to obtain a bachelor’s degree. Then there are the 40 percent of students who start college and don’t even finish, yet still have the debt to contend with.

Some elected officials have called for cancelling at least some of this student loan debt, which they deem a drag on these new graduates, as they attempt to launch their careers. However, how fair is that to those who previously paid off their loans, or worked while going to school to mitigate their costs?

Because the anticipated costs are so daunting, financial planners encourage their clients to open college accounts as soon as possible after a child is born, and then make regular contributions. Even so, there is still the aforementioned $1.6 trillion in debt. Of course, the college account contributions are on top of housing, utilities, taxes, insurance, food and healthcare for most households. Then there is the cost of healthcare, which I’ll discuss in the next segment.

Some elected officials, including US Senator Marco Rubio from Florida, have taken issue with the current relationship between rising college costs, readily available financing and the growing burden of debt for students. There is also the question of how all this money from state aide, tuition and endowments is actually spent.

According to Kay C. James, a visiting fellow at the Heritage Foundation, between 1987 and 2012, our higher education system added more than half a million administrators, doubling the number of administrators relative to the number of faculty. If we look at the root cause of why college is so expensive, this might be a good place to begin.

Other elected officials think the answer is to pass federal legislation which would make college tuition free, beginning with a two-year degree. But what message would that send to the colleges and universities, and what incentive would they have to contain or lower tuition costs if they know there is yet more funding coming their way? Moreover, how fair is it for the millions of students who paid their own way through work or borrowing?

Despite all the attention on the costs and the debt, colleges continue to raise tuition. In addition, since federal loan money is handed out with little scrutiny as to the student’s ability to pay it back, colleges have had free rein to raise prices at their whim, and at rates often double the rate of inflation.

Getting back to free tuition on the backs of taxpayers, with federal loans accounting for much of the $1.6 trillion in outstanding student loan debt, and more than a million people defaulting on their loans each year, taxpayers are already picking up much of the tab for this broken system.

If we are to ever address the never-ending upward trend of college tuition, and the massive student debt that goes with it, we must take a hard look at the root causes of the costs, beginning with how our schools spend the money and what percentage actually goes toward instruction. Also, does the quality of the education received justify the costs and the borrowing to obtain a degree? Some would say American colleges and universities are failing in their most basic mission to equip students with the tools they need for a successful career.

Now that we’ve discussed potential root causes for high property taxes on Long Island, and the burden of saving and financing the extravagant cost of college, there is still one more topic to discuss. This one is perhaps the most ominous of all, as it has the potential for catastrophic repercussions, the cost of healthcare. Stay tuned for segment 3.