Image

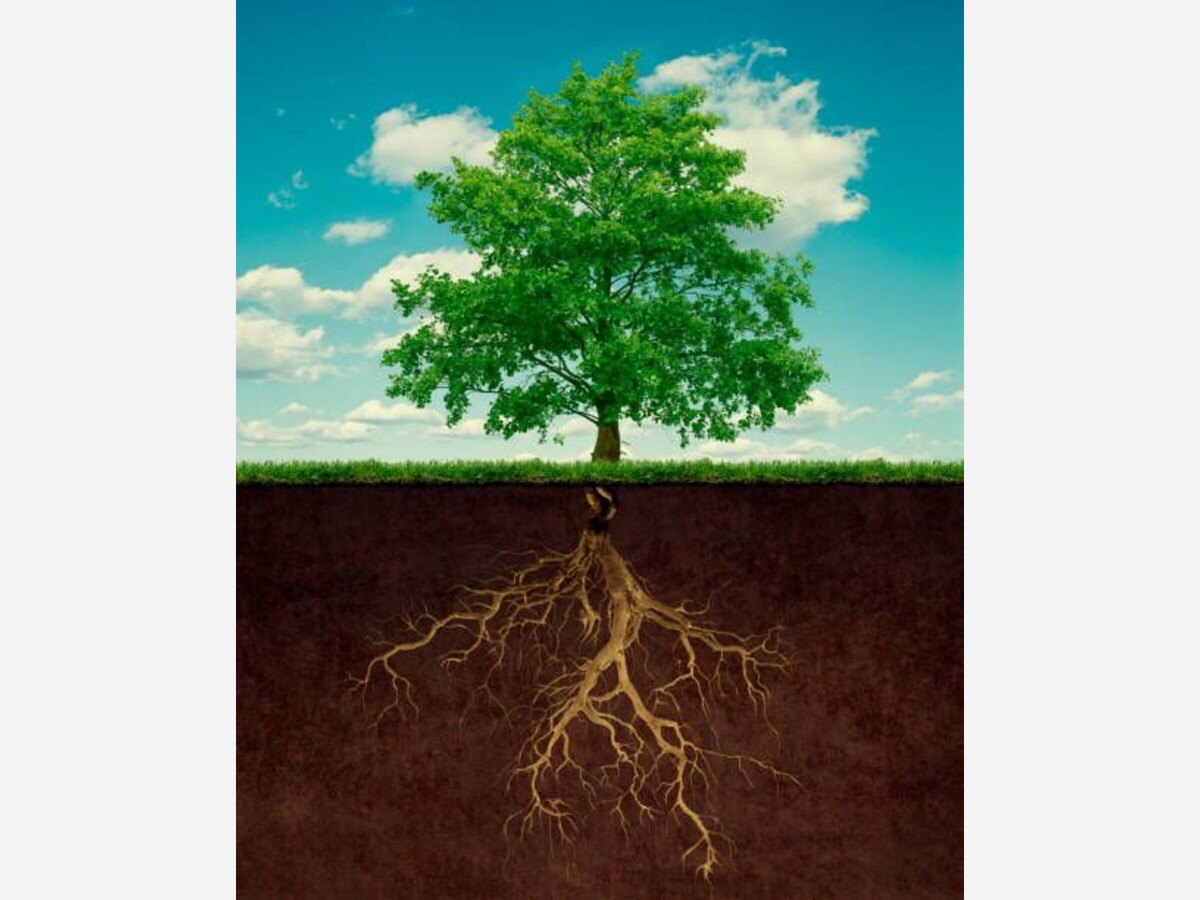

Root cause analysis, or RCA, is a well-known methodology to attempt to determine the “why” in why something happened, or why a situation is the way it is. A good example is hospitals and medical centers use RCAs following an unintended outcome, or even a medical malpractice lawsuit, to assess what mistakes may have been made, and what can be done to make things better. The goal is to improve care and avoid future errors, certainly worth the effort of conducting RCAs.

Recently I attended a one-to-one meeting with State Senator Mario Mattera. We discussed Governor Hochul's proposal to override local zoning laws to allow and encourage the creation of apartments and cottages in single family homes, traditionally zoned for single family use in residential neighborhoods.

The plan is designed to address the need for affordable housing on Long Island, given Long Islands high home values, high property taxes, high rents and other punitive living expenses. Opponents say the plan would create traffic and burden water and sewer districts, as well as alter the character of single-family neighborhoods.

Everyone knows, and the data backs it up, that Long Island has the 2nd or 3rd

highest property taxes in the country, more than twice the national average, according to Heller and Consultants, a local tax grievance company. These property taxes are coupled with the high cost of buying a home, high rents and high utility bills. Long Islanders also pay 8.8 sales tax and an income tax of between 4 and 10.9 percent.

On top of Long Island’s “baseline” costs of taxes, rents and utilities, the country as a whole now faces the highest inflation in the past 40 years. These costs are affecting everyone except perhaps the wealthy, who can well afford to weather the storm. But for most people, the effects are being felt at the gas pump, the grocery store, and of course when paying our heating and utility bills. There is now evidence that insurance companies are preparing to raise rates on homeowners due to the rising costs of building supplies, not to mention the supply chain situation, predicted to last the rest of the year.

Getting back to Governor Hochul’s plan to facilitate the creation of housing units in single family neighborhoods, which she has since withdrawn, shouldn't we consider the root causes of the affordable housing crisis. If indeed property taxes are the culprit, then a strategy should be developed to lower them. The STAR program has a negligible benefit of keeping taxes from rising more than 2 percent. Meanwhile, the costs of buying and owning a home are contributing to the affordable housing crisis, and property taxes have a lot to do with it.

Now that the State has received millions in revenue from on-line gambling, can those funds be used as direct rebates to lower taxes? If the funds go to the schools, which is the plan, then what incentives will the school districts have to lower costs and consolidate expenses, which make up the largest share (65-70 percent) of property taxes. A root cause analysis could provide some answers and possibly slow down this vicious cycle.

While market forces certainly effect the cost of a home, at least our local governments should do more to lower property taxes. That would address at least one root cause for the affordable housing crisis. If the State can harness millions from on line gambling, then New Yorkers deserve to have their costs lowered. Putting these funds in the hands of residents either directly or as tax rebates, would actually have a realistic effect on not just “creating” affordable housing units, but making existing homes and apartments more affordable to begin with.

Over the next several weeks, I will discuss two areas where costs have been going up twice the rate of inflation for 20 years or longer, healthcare and college.