Former Smithtown Town Supervisor John V. N. Klein and the Suffolk County Farmland Preservation Program

By Karl Grossman

Suffolk County in recent years has been the only region in the state to increase its number of farms and add farmland, according to a report titled “A Profile of Agriculture in New York State,” done by the office of the state’s comptroller, Thomas P. DiNapoli.

The report includes data from 2017 to 2022, a period in which the state lost 8% of its farms while Suffolk added 18 farms, a jump of 3%. The number of farms in Suffolk in 2022 totaled 578, it says, the amount of farmland 33,821 acres.

The Suffolk figures are in the “Overview of Long Island Farms” section of the report which also includes Nassau County. The number of farms in Nassau is listed as 29, with three farms “lost” between 2017 and 2022. Its farmland totals 665 acres.

“Historically, Long Island had a major farming presence,” says the comptroller’s report, “but losses of farmland to suburban development resulted in this region having the lowest number of farms (607) and the least amount of farmland (34,486 acres) of any region outside of New York City.”

In the study period, “Strong growth in farms and farmland in Suffolk County offset losses in Nassau County to make the Long Island Region the only one in the state to see growth in both categories.”

The report, issued in November, adds: “With 85 wineries, Long Island ranks second among regions, and growth in these enterprises in Suffolk may help explain the county’s growth in farms and farmland. Suffolk County’s 79 wineries harvested the third largest acreage of grapes in the state.”

That shift from farmland devoted heavily to growing potatoes in Suffolk to grapes for wine started with a visionary and enterprising young couple, Louisa and Alex Hargrave, launching the Hargrave Vineyard in Cutchogue in 1973.

Moreover, in saving agriculture in Suffolk were two governmental initiatives which became realities after passage in referenda here: the Suffolk County Farmland Preservation Program and the Peconic Bay Community Preservation Fund.

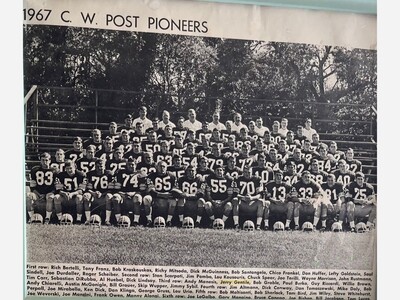

The inspiration for the Farmland Preservation Program was a ride over Suffolk in a helicopter taken by former Smithtown Town Supervisor John V.N. Klein who became its county executive in 1972. Klein grew up in a bucolic Fort Salonga in the Town of Smithtown and was looking down viewing western Suffolk, so much of it having quickly become overlaid in subdivisions and shopping centers, a stark contrast from when he was young.

Then, eastern Suffolk appeared below, green and verdant, with many farms, and their unusual placement juxtaposed with water—the Atlantic Ocean, Long Island Sound and numerous bays.

Klein began thinking about how this could be saved. The solution: the first-in-the-nation concept of purchase of development rights to save farms.

Suffolk County would pay the owners of the farms the difference between what they were worth in agriculture and the amount if they were sold for subdivisions. In return, the owners would sign binding legal papers keeping the land remaining in agriculture in perpetuity.

Since the program, approved in a countywide referendum, began in 1974, more than 11,000 farmland acres have been preserved through it. And this, in turn, has been integral in continuing Suffolk as a major site for tourism—as well as a source of fresh food close by.

Preserved has been not only farmland in eastern Suffolk, but also in central and western Suffolk. The concept of purchase of development rights that was pioneered in Suffolk has been emulated across the United States as a way to save farms.

The Community Preservation Fund has a scope that is in addition to preserving farms. It was modeled after a two-percent buyer-paid real estate transfer tax initiated on the island of Nantucket by a nephew of John V.N. Klein, Bill Klein. Raised in Syosset in the 1960s, he understood sprawl. At 27 years old, he arrived on Nantucket in 1974 as its first planner.

The concept to deal with the development explosion on Nantucket: a 2-percent real estate transfer tax to go toward open space preservation that Bill Klein was familiar with from an earlier planning position in Pennsylvania. The tax was approved by Nantucket voters with “near unanimity,” he said. It took effect in 1984. That year, then East Hampton Town Supervisor Judith Hope, on a trip to Nantucket with her husband, the late attorney and environmental activist, Tom Twomey, read about it and brought the concept back to Suffolk County.

Spearheading a measure for a 2-percent real estate transfer tax in Suffolk County similar to that on Nantucket were State Assembly members Fred W. Thiele Jr. of Sag Harbor and DiNapoli of Great Neck Plaza in Nassau County. DiNapoli was then chair of the New York State Assembly’s Environmental Conservation Committee.

It was passed by referenda in each of the five East End towns and took effect in 1999. The money raised—nearly $2.5 billion so far—goes for the preservation of farmland, and also saving open space, critical groundwater recharge areas, historic places and structures, recreational opportunities, culturally significant properties, and parks.

Long Island might have a relatively small number of farms and amount of farmland but, as the report notes, Suffolk in 2022 “harvested” the “largest acreage” and the “second most” acreage in the state of various vegetables it lists. Suffolk is “a commodity sales powerhouse,” it says. And “Long Island also dominates aquaculture sales in the state” with Suffolk “ranking 1.”

In his comments in his office’s report, DiNapoli says: “The critical role farms play in New York cannot be overstated, both as an economic engine for their communities and an essential part of our food supply system. This is especially true on Long Island,” he adds, noting the gain in farms and farmland in Suffolk in recent times.

DiNapoli continues: “In recognition of the importance of agriculture to New York, the state’s policymakers have adopted tax credits and other forms of assistance for farmers. State government must ensure that agriculture in New York continue to support local economies and provide the food we all need,” and “if you have eaten today, thank a farmer.”